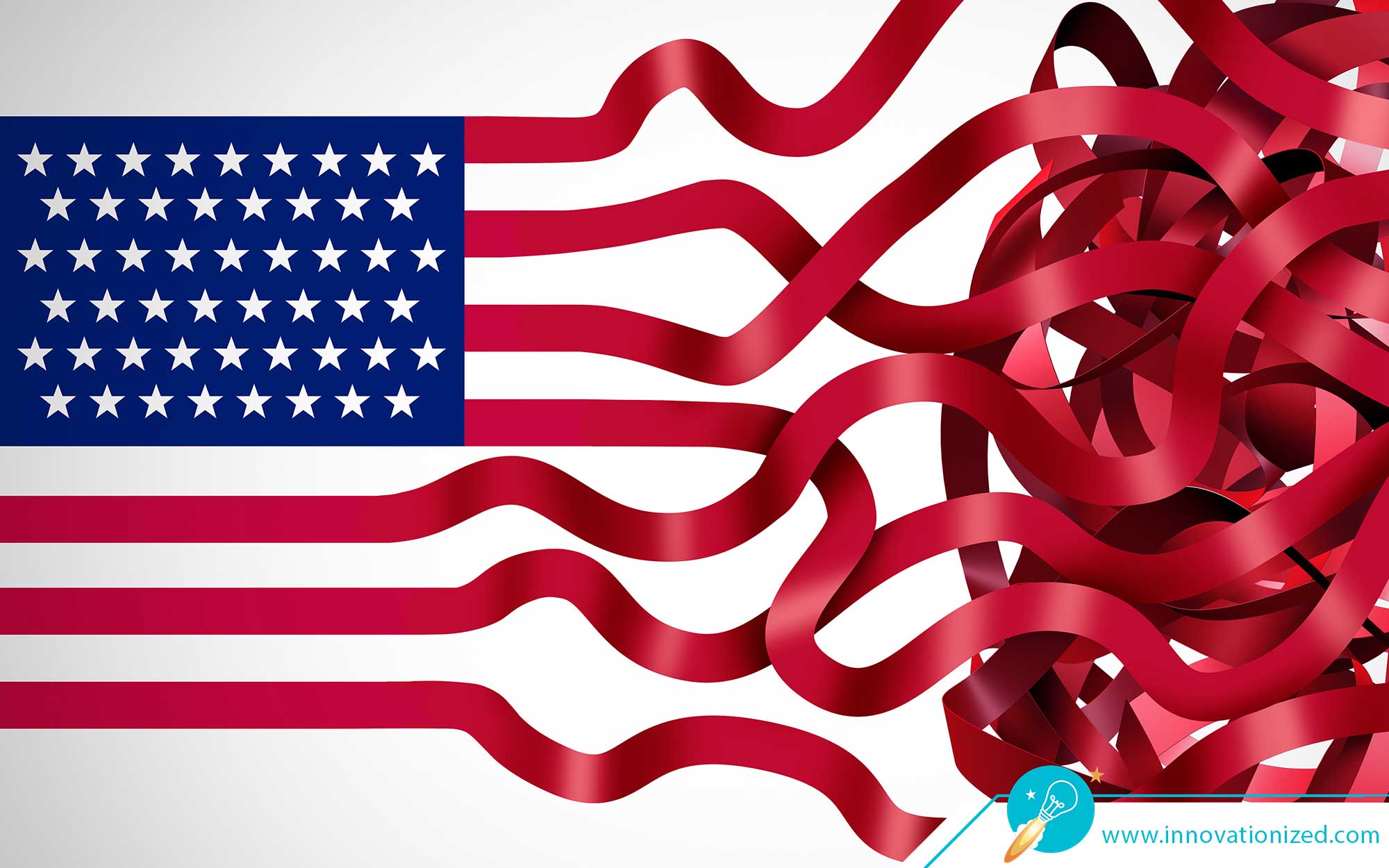

There is an indiscriminate and unstoppable, vampire, sucking the lifeblood out of every American.

That vampire is inflation.

It sucks value out of income and savings, punishes responsible saving and investment, and urges reckless spending. Henry Hazlett explained its effects:

“Inflation itself is a form of taxation. It is perhaps the worst possible form, which usually bears hardest on those least able to pay. [It is] a flat tax of the same percentage, without exemptions, on everyone’s income…on his savings account and life insurance. It is in fact a flat capital levy, without exemptions, in which the poor man pays as high a percentage as the rich man.

“But it is worse than this. The poor are usually more heavily taxed by inflation in percentage terms, than the rich, for they do not have the same means of protecting themselves by speculative purchases of real equities.”

“It discourages all prudence and thrift. It encourages squandering, gambling, reckless waste of all kinds. It often makes it more profitable to speculate than to produce. It tears apart the whole fabric of stable economic relationships. Its inexcusable injustices drive men toward desperate remedies. It plants the seeds of fascism and communism. It leads men to demand totalitarian controls. It ends invariably in bitter disillusion and collapse.” [Henry Hazlitt, Economics in One Lesson, 176]

“Inflation is a form of taxation, only worse…” -Henry Hazlett

Inflation, a widespread and systematic increase in prices, is not caused by pandemics, by supply chain disruption, or any other temporary impact on prices of commodities. These transitory events pass, and prices return to previous levels as supply catches up to demand, or demand (stimulated by unusual events) falls.

The temptation of inflation is driven by a childish confusion between money and wealth.

It is the confusion between the means of exchange, money, and wealth itself, the supply of goods.

It is the belief that simply printing money (or creating credit) will magically create the latter, wealth.

It is equivalent to believing that printing ten dry cleaning tickets for your local dry cleaner, will mean you be able to magically pick up an extra ten items at the dry cleaners.

As Jeffrey Tucker points out:

“Prosperity is built through the construction of capital, which is the institution that embodies forward thinking. To make capital requires the deferral of consumption: You must give up some today in order to make tools that enable more consumption tomorrow. This means discipline and a future orientation. And it means, above all, savings that can be invested in productive projects. Only through that path can societies grow rich.” [Jeffrey Tucker, “How Inflation Changes Culture,” Gilder’s Daily Prophecy, August 1, 2022.]

The “adults in the room” have robbed the nation, undermined future innovation, and turned everyone into short-sighted “live for today” teenagers.

We will pay for this act of debasement for a long time.